Managing SaaS forecast uncertainty and negative growth

How SaaS start-ups can face the challenge of planning and forecasting for negative growth

I’ve recently been speaking to a few start-ups and, with slowing economic growth and uncertainty, I’m hearing how SaaS start-ups are facing the challenge of planning and forecasting for potential negative growth. SaaS revenue growth for start-ups has dropped from 40% to 20% year-over-year, 1 in 5 startups are facing down rounds, and the economic outlook is unstable. So how can startups bring predictability back to their businesses amidst volatility?

The key is managing the uncertainty. There are a few things I recommend when confidence in predictions falters

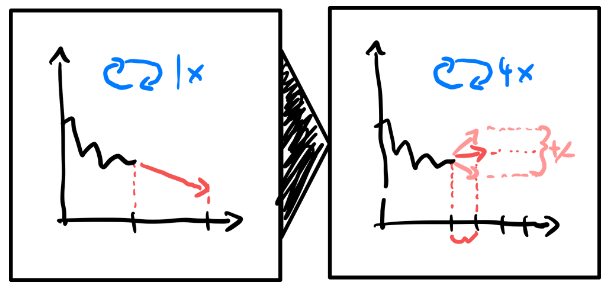

Increase forecasting/planning frequency to adapt to quicker changes. For example, consider weekly vs. biweekly forecasts or quarterly planning vs. annually. This gives you the room for flexibility and allows you to adapt to new information more quickly. However, avoid over-reacting and making continuous “just-in-time” updates, it is critical to still plan ahead strategically and figure out where the puck will land vs. where it is now.

Shorten prediction timeframe when volatility is high. A shorter timeframe balances out the aforementioned higher frequency and gives you higher confidence based on information available now. For example, forecast out only 1 month vs. 1 quarter to limit uncertainty. Try to find a balance between having the right information available now to make confident predictions with having sufficient runway insight into the future of your business.

Segment your predictions by confidence. Break down your predictions into categories of confidence; e.g. 99% 90% and 50%. This gives a pyramid of sorts of confidence and you can understand how your business will likely build up based on predictions that are highly confident, to things that have some volatility to things where there is much risk.

Higher variance scenarios. By growth pivoting, it’s clear variance has already increased. So accept a higher variance and plan for according scenarios. Your confidence segmentation should give a good idea of how much your variance might increase. Plan for various scenarios accordingly, especially on the downside when it comes to costs you need to cover. Pressure test properly and then work your way back up to the mean.

Highlight risks and assumptions. Addressing and managing prediction risks is critical in avoiding a fire drill a few months down the line. Vetting assumptions is equally important to (re-)build confidence.

Now, while planning for declining growth, don’t forget about the upside potential!